Mastering Apartment Pro Formas Under Uncertainty

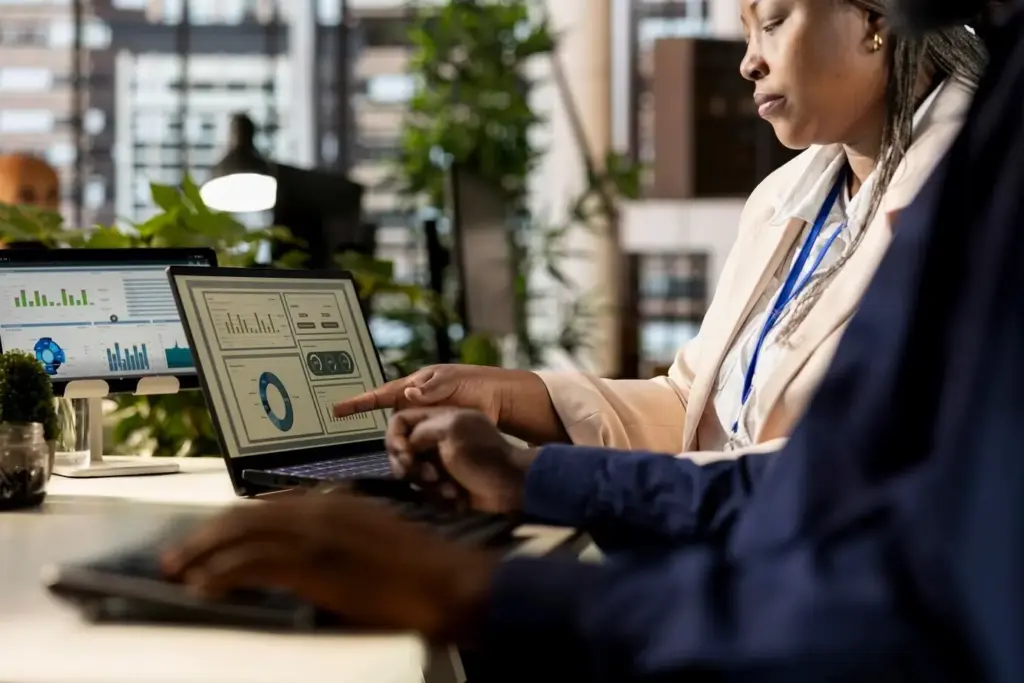

Today we dive into Sensitivity Analysis of Rents, Vacancies, and Expenses in Apartment Pro Formas, revealing how small assumption shifts can ripple through NOI, DSCR, IRR, and valuation. You will learn practical checks, modeling patterns, and communication habits that convert swirling uncertainty into clear, decision-ready insights for acquisitions, development, refinances, and asset management.

Defining the Baseline and Framing the Question

Start by anchoring a crystal-clear baseline model that everyone trusts. Lock inputs for unit mix, asking rents, concessions, economic and physical vacancy, operating expenses, taxes, insurance, reserves, and capital timing. Decide which outputs matter most—NOI, cash-on-cash, DSCR, IRR, equity multiple—and specify exact horizons. Establish consistent conventions for growth timing, mid-period discounting, and lease-up logic so that each sensitivity test compares apples to apples and reveals signal, not spreadsheet noise.

Assemble a Clean Baseline Pro Forma

Audit formulas, remove circularity traps, and standardize timing rows before touching any sensitivity setting. A deal team once burned two weeks debating rent pressure, only to learn their occupancy math double-counted concessions. Clean structure avoids phantom volatility and ensures every change traces a defensible path to NOI and cash flow.

Clarify Outcome Metrics that Matter

Agree early on which metrics drive decisions. Lenders often anchor to stabilized DSCR and debt yield, while equity focuses on levered IRR, equity multiple, and downside protection. Establish breakevens—rent per square foot, vacancy ceiling, expense shock tolerance—so sensitivity outputs translate into concrete, fundable guardrails rather than abstract percentages.

Choose the Sensitivity Axes and Ranges

Define ranges grounded in market data, not comfort. Use broker rent comps, trailing vacancy by unit type, and insurance quotes to set realistic bounds. Resist timid ±2% moves when recent tax reassessments swung thirty. Document sources beside each assumption so stakeholders trust both the direction and the magnitude of your tests.

Rent Assumptions: Growth, Concessions, and Elasticity

Rent is deceptively simple: a few dollars per unit can make or break coverage, yet demand responds to price, amenities, and neighborhood momentum. Explore paths for initial pricing, renewal lift, and new-tenant premiums. Track loss-to-lease, seasonality, and concessions as separate drivers. Calibrate growth to wage trends and supply deliveries, then test how marketing spend, unit renovations, or amenity upgrades alter achievable rent without eroding absorption or resident satisfaction.

Vacancy and Lease-Up Dynamics

Vacancy is not a single knob; it blends physical, economic, and frictional components. Model lease-up with an absorption curve that reflects unit mix, seasonality, and construction timing. Tie renewal probability to rent hikes and service quality. Include make-ready days and turnover costs. Sensitivity across these levers clarifies whether a polished leasing plan beats riskier pricing strategies in protecting early-year cash flow and covenant compliance.

Inflation Ladders and Vendor Risk

Model separate inflation paths for payroll, materials, and services. Add a vendor concentration flag—if a single contractor covers elevators, a disruption can cascade. Sensitivities that mix modest inflation with intermittent shocks better mirror reality, guiding whether to lock multi-year contracts or keep flexibility for opportunistic rebids.

Utilities, Taxes, and Insurance Shocks

Create jump scenarios: reassessment after renovation, utility repricing, and post-storm insurance hikes. A Houston asset saw premiums double in a year; the earliest sensitivity runs preserved DSCR by trimming non-critical CapEx and implementing water-saving retrofits. Testing these jolts in advance keeps covenants safe and investor updates calm.

CapEx, Reserves, and Timing Effects

CapEx timing changes outcomes even when totals match. Stagger renovations to protect occupancy, or go fast to capture rent uplifts sooner. Reserve policies shape lender comfort; sensitivity tests show how a slightly larger reserve offsets downside tails, stabilizing distributions and smoothing refinancing narratives.

One-Way Tornado Charts for Clarity

Rank-order drivers by impact on IRR or DSCR with tornado charts. Stakeholders instantly see the longest bars—often taxes, vacancy during lease-up, and insurance. This visualization builds alignment, helping teams pick two or three assumptions for deeper diligence rather than spreading effort thinly across minor inputs.

Two-Way Heatmaps for Interaction Effects

Cross rent with vacancy, or taxes with insurance, to reveal thresholds where outcomes flip from acceptable to stressed. Heatmaps surface cliffs, like a combined tax reassessment and premium hike that squeezes coverage. These plots guide contingency buffers, covenant negotiations, and sequencing of operational initiatives to stay inside safe zones.

Monte Carlo with Correlations and Fat Tails

Randomize inputs responsibly. Correlate rent and vacancy inversely, link insurance and taxes modestly, and allow occasional extreme draws to mimic real markets. Report percentile outcomes and shortfall probabilities, not just averages. This perspective turns uncertainty into quantified risk, sharpening debates around leverage, reserves, and timing of capital events.

Interpreting Results and Communicating Decisions

Analysis matters only when it changes behavior. Convert sensitivities into thresholds, playbooks, and if-then actions. Identify breakeven rent, maximum tolerable vacancy, and expense shock buffers for each period. Package insights clearly for lenders and investors, showing what you will monitor, how you will respond, and which early-warning indicators trigger action, preserving credibility through choppy conditions.

Practical Toolkit: Data, Templates, and QA

Speed and consistency are advantages. Maintain a structured assumptions tab, version control with changelogs, and a library of ready-made sensitivity templates. Validate against trailing actuals and third-party reports. Keep an issues log for surprises and fixes. Invite readers to request the template pack, share their favorite checks, and help refine a living toolkit that keeps every model honest.